5 Pullback Trading Tricks

As a trader, something that you should be familiar with is pullback trading. This is a type of trading that can be applied to Forex, stocks, commodities, and other markets too. In case you don’t know, in trading, a pullback is when a stock, currency, or other asset type moves in the opposite direction of the long term trend.

Pullback trading can be very useful to make a quick dollar, especially if you know how to spot pullbacks before or as they are occurring. That being said, this type of trading does have some difficult aspects to it. After all, you need to be able to identify a trend in order to spot a pullback.

Anyway, today we want to talk about 5 pullback trading tricks, 5 things that you need to do before you place a trade. If you follow the 5 tips we have outlined here today, you should have no problems with making a profit via pullback trading.

Trade with the Trend

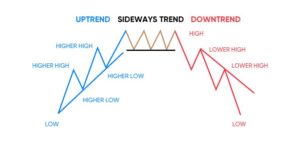

The first thing that you need to do in pullback trading is to identify a trend. Remember, pullbacks are short terms movements that occur in the opposite direction of the long term trend. Therefore, identifying a trend is very important.

Moreover, you need to find a trend that is relevant to the timeframe which you are trading on. For instance, if you are trading on an hourly timeframe, then you need to be able to see a trend on the hourly chart.

The most important thing to remember here is that pullback trading only works if the market is trending. If the market is not trending, then this kind of trading will not work.

Identify the Type of Trend

Now that you have identified a trend on a chart for the specific timeframe you are trading at, the next important thing for pullback trading is to identify the type of trend. The reason for this is because not all trends are the same, and therefore not all pullbacks are the same.

There are 3 types of trends. A weak trend is when the price respects the 200 moving average and remains above it, a healthy trend is when the price respects the 50 moving average and remains above it, and a strong trend is when the price respects the 20 moving average and remains above it. This in turn can then lead to shallow pullbacks or deep pullbacks.

In case you are wondering what the purpose of identifying the type of trend on a chart is, it is so you can identify the areas of value on the charts. In other words, this helps you identify when to enter a pullback trade, something we will discuss more further below.

Identify the Area of Value

The next thing that you need to do before executing a position in pullback trading is to identify the area of value. For example, in an uptrend, the area of value is the area on a chart where buying pressure could push the price higher, and in a downtrend, the area of value is the area on a chart where selling pressure could push the price lower.

For example, if there is a strong uptrend, the area of value will usually be at the 20 moving average line. If there is a healthy uptrend, the area of value could be at the 50 moving average line. If the uptrend is weak, the area of value may be at the 200 moving average line. The point here is that the area of value, as the name implies, refers to a general area on the chart, not a specific price.

Identifying the Entry Trigger

Once all of those previous conditions are met, for pullback trading, you then need to find the entry trigger or the ideal pattern. Keep in mind that the conditions include trading with the trend, identifying the trend, and identifying the area of value. Let’s go over some pullback trading entry trigger examples.

For a strong trend, as we have discussed, will have a shallow pullback and will remain above the 20 moving average. In this case, buying on a pullback can be hard, because it will usually be short-lived, with the trend resuming higher. The best way to approach this is to buy on the swing high.

If the trend is weak, the pullback will usually be quite deep, and it could retest the 200 moving average line. Here, for an entry trigger, you could look for a bullish candlestick reversal pattern.

Exiting in Pullback Trading

The final part to pullback trading is to know when to exit a trade. You can exit a trade when you are right and you can exit a trade when you are wrong. If the market moves in your favor, or in other words, if you are right, there are various ways to exit the trade.

For instance, in a strong trend, the best method is to ride the trend and use the 20 moving average line to set your stop loss, so that the trade closes only when the price dips below it. For a healthy trend, you could exit the trade by capturing a swing. You could use the 50 moving average line to ride the trend, although this can be dangerous.

For a weak trend, pullbacks can be deep, and therefore you need to avoid riding the trend. To exit a pullback trade in a weak trend, you want to capture a swing at the previous swing high or at an area of resistance.

The Basics of Pullback Trading

The bottom line is that pullback trading can be quite profitable, but you do need to know what you are doing. If you follow the 5 steps of pullback trading as listed above, you should have no problems entering and exiting trades the right way, with the end goal of course being to make a profit. If you are wondering how long it will take you to become a profitable trader, check out this article.