COVID-19 & Trading Forex

There is no denying the fact that COVID-19 has had a massive impact on the Forex market and on financial trading in general. At this point, there are nearly 30 million cases of COVID-19 worldwide, with nearly 1 million deaths.

COVID-119 has hit some countries much harder than other, with the USA, Russia, Brazil, India, and South Africa being by far the hardest hit. With economies appearing to teeter on the brink of total collapse, unemployment rates soaring, and more, some wonder how exactly the world will recover from this pandemic.

More so, traders are wondering how exactly COVID-19 is affecting the markets, specifically the Forex market. With some countries being so severely impacted by this horrible disease, it’s fair to assume that some national currencies are currently seeing massive volatility. So, how is COVID-19 affecting Forex trading, and is there anything you can do to mitigate risk and make a profit?

COVID-19 Impacts on the World

There are various effects which COVID-19 is having on the world economy, particularly in a few sectors. Let’s take a look at some of the biggest impacts right now.

Soaring Unemployment

One of the biggest factors that is currently affecting the financial market, particularly in Forex trading, is soaring unemployment. Since the beginning of the pandemic, unemployment rates around the world have increased quite drastically.

The lockdowns and quarantines have caused the closure of so many business. Just think of all of the restaurants, recreational businesses, casinos, and so much more that have all been forced to shut down.

At this point, the ongoing loss of employment is on track to be much worse than the skyrocketing unemployment rates seen during the 2008 financial crisis.

For example, the USA is currently seeing one of the highest unemployment rates in 100 years. Since the beginning of the COVID 19 pandemic, over 26 million Americans have applied for social assistance, with the current unemployment rate at 14% and rising.

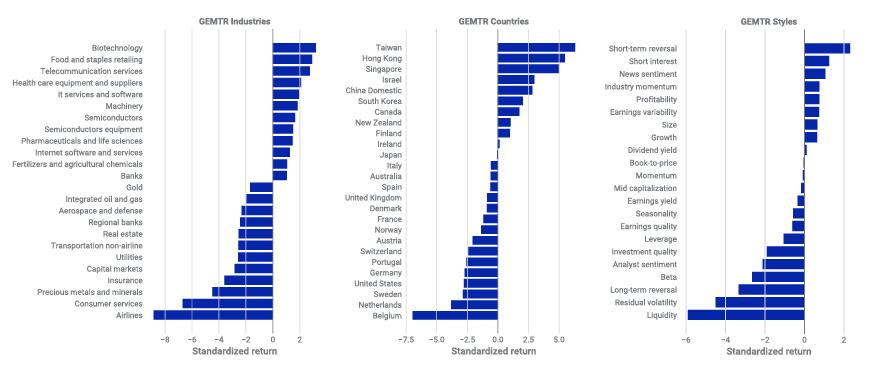

Stocks & Forex Trading

Another effect that this COVID-19 pandemic has had on the economy is that traders are trading with fear driven risk-off patterns. This has seen the demand for the US dollar as a safe haven currency, due to its current status as the global reserve.

There were some good signs of optimism where traders showed risk on trading patterns, with the US dollar being sold off and the Dow Jones rising in value.

However, these moments of optimism appeared to be very short lived. It is not likely that current prices reflect what is going to happen in the long term. One must take into account the impact of mass unemployment, massively overleveraged corporate debt, market restructuring, and more.

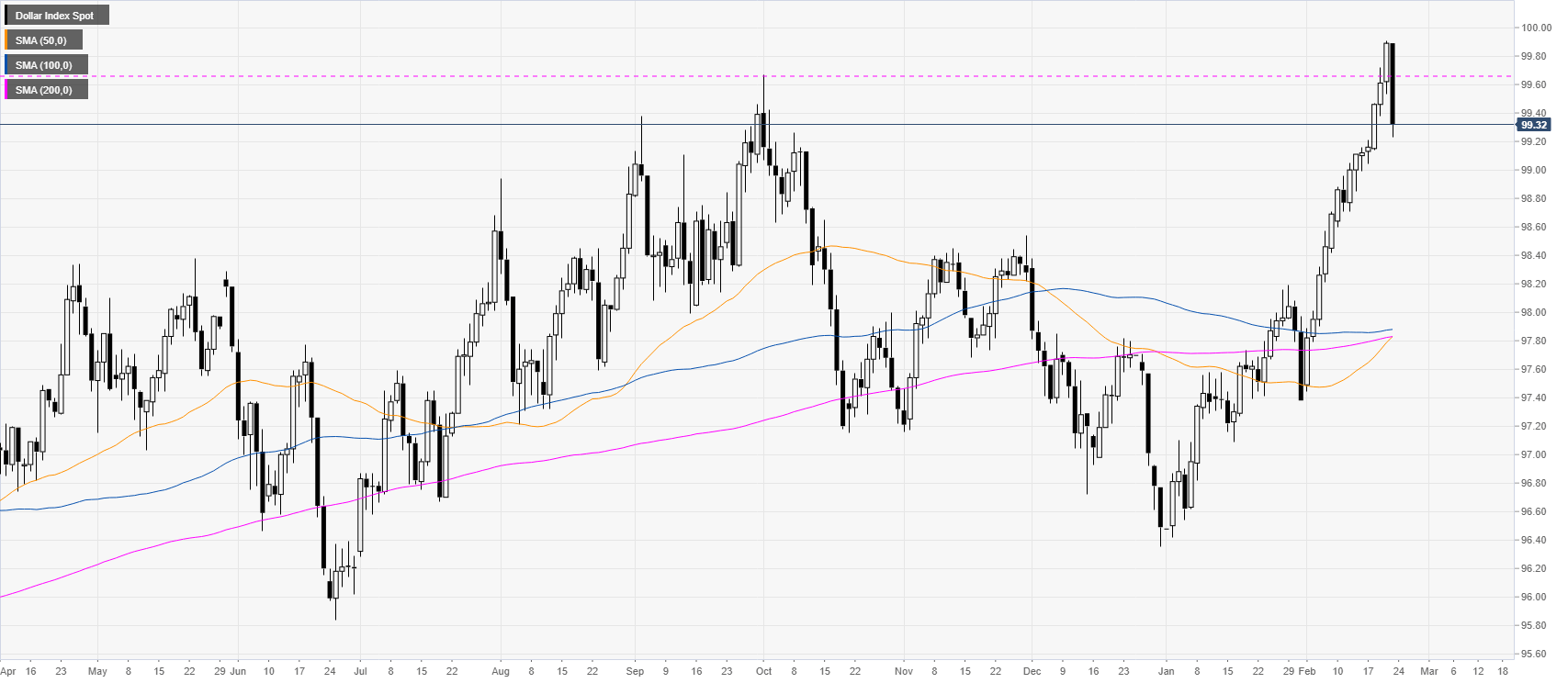

The Dollar Index

When one looks at various factors, such as U.S. equities, U.S. interest rates, and unemployment, the movement in these areas would suggest the sustained strength of the US dollar.

These indicators are all undergoing super volatile swings. However, for the time being, there appears to be support for the traditional safe haven currencies such as the USD, JPY, and CHF.

Forex Trading – Managing Your Risk

In these highly volatile times, when it comes to trading Forex, there are some things that you can do to protect yourself. Yes, COVID-19 is having a massive impact on the way that people are engaging in Forex trading. So, what are some of the things you should consider when trading Fore during the COVID-19 pandemic?

Lowering Your Risk Ratio

One thing that many Forex traders are doing to protect themselves during the COVID-19 pandemic is to reduce their risk. Before, many traders may have risked up to 5% of their available capital in a single trade.

Well, if you lose 20 trades in a row, this would wipe out your account. Therefore, many traders have decided to lower their risk to reward ratio by risking only 1% to 2% of their available trading capital per trade.

Limited Trade Duration

Daily and weekly developments in the COVID-19 situation continuously and constantly affect Forex trading. For the best trading results, you have to constantly monitor the COVID-19 situation, taking recent developments into account.

However, it is not possible to monitor positions around the clock, and not on the weekend either. Therefore, when it comes to Forex trading, and trading in general, man traders are opting to close their positions before market close at the end of each day.

Using Stops

Something that Forex traders must now consider more than ever is using stop loss orders to prevent excessive losses from occurring. Yes, high market volatility can lead to big time profits in some circumstances.

However, that same high level of volatility can also just as easily lead to massive losses. Therefore, using stop loss as a risk management tool is now more important than ever. Traders must at all costs analyze markets and set stop loss levels accordingly.

Yes, traders may increase stop distance from the entry price to allow for greater movement and to account for potential upturns, but of course, this also comes at the price of a much higher level of risk in the event that a trade goes south.

Leveraging in Forex Trading

Something else which traders may consider doing is to increase the amount of leveraging being done on trades. The increase in market volatility, when combined with increased leverage ratios, can lead to mc higher profits, particularly during this uncertain time of COVID-19.

However, just like with widening stop loss distances, increased leverage ratios in Forex trading, while it can lead to higher profits, may also lead to bigger losses. Remember folks, it’s all about balancing risk and reward.

Forex Trading During COVID-19 – Final Thoughts

The bottom line is that times are very uncertain right now. The COVID-19 pandemic has sent many countries into an economic downturn. However, there are signs that the USD and other currencies are still seen as safe havens. For the best results when trading Forex during COVID-19, one must constantly monitor new developments.