Trading Forex Successfully: Profit Secrets

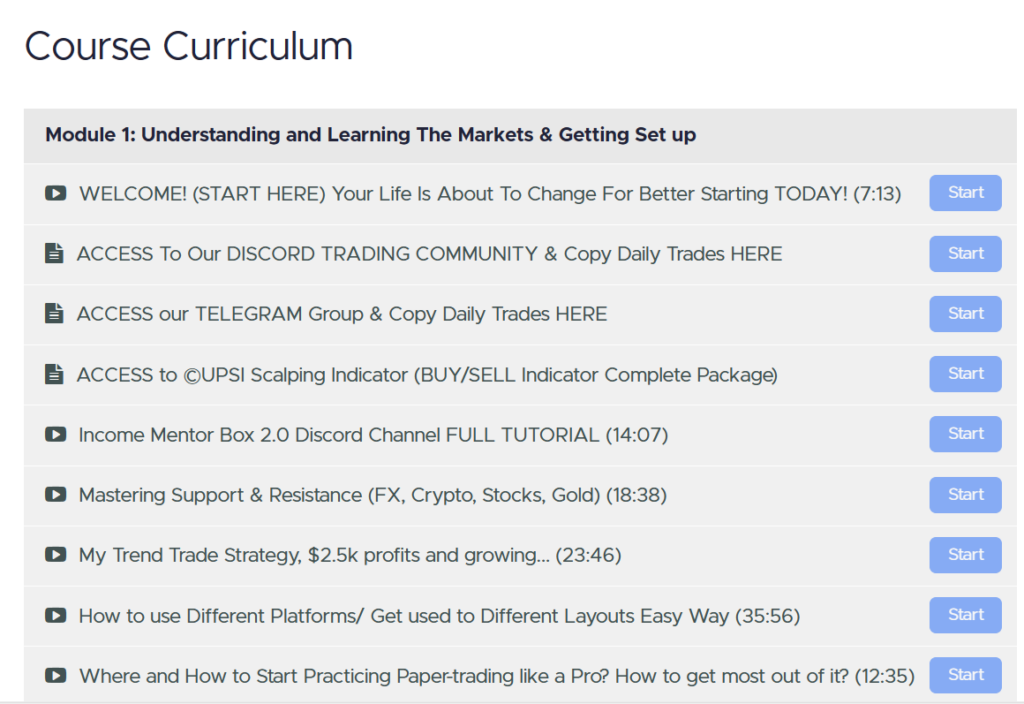

Entering the Forex market can be a formidable endeavor for beginners, filled with potential pitfalls and opportunities alike. The best way to navigate this journey is with the support of seasoned professionals, and that’s where the Income Mentor Box Day Trading Academy excels.

Offering an all-encompassing curriculum that caters to both the theoretical and practical aspects of Forex trading, Income Mentor Box is committed to molding novices into savvy traders. Don’t let the complexities of Forex trading hold you back. Enroll in the Income Mentor Box Day Trading Academy and unlock your trading potential.

Embrace the Discipline of a Trading Journal

The discipline of keeping a detailed trading journal is paramount for a trader’s growth and self-regulation. Documenting every aspect of your trades, from the date and currency pairs involved to the specific entry and exit points, size of the trade, outcomes, and the rationale behind each decision, serves multiple crucial functions.

It not only facilitates a deep dive into the efficacy of your strategies and identification of repetitive errors but also aids in pinpointing areas ripe for refinement. As you consistently log your trading activities, you’ll start noticing trends and patterns that could lead to optimizing your trading approach.

Moreover, a trading journal acts as a mental anchor, fostering a more deliberate and calculated approach to trading. This treasure trove of personal trading history becomes a vital asset in shaping a more proficient and effective trading identity.

Prioritize Skill Development Over Immediate Gains

The pursuit of quick profits can often lead to a spiral of emotional trading, excessive trading, and unnecessary risk-taking, which are traps that ensnare many traders. A more sustainable path to success in the forex market focuses on honing trading skills and methodologies.

This journey involves cultivating discipline, nurturing patience, and honing the capability to base trade executions on thorough analysis instead of impulsive reactions to market fluctuations.

As you dedicate yourself to improving these fundamental skills, you will likely find that your decision-making process becomes more consistent and your trading more profitable. Transitioning your focus from chasing short-term financial gains to committing to long-term skill mastery is essential for a durable and prosperous trading career.

Comprehend Trading Expenses Thoroughly

Understanding the intrinsic costs associated with each trade is crucial for navigating the forex market successfully. The spread, or the difference between the buying and selling price, can significantly affect your profitability, particularly if you engage in frequent trading or deal with substantial volumes.

Additionally, commission fees charged by some brokers for every trade and the swap or rollover fees for positions that remain open overnight can further diminish your returns.

Being acutely aware of these trading expenses is essential when selecting a broker and formulating a trading strategy that matches your trading style. Opting for a trading approach that involves numerous small transactions may not be economically viable with a broker who imposes high spreads or commission fees.

Strategically Employ Technical Indicators for Forex Profits

Technical indicators serve as critical tools for forecasting future market trends by analyzing past price actions and volume. However, an over-dependence on these indicators can unnecessarily complicate your trading strategy. Beginners often fall into the trap of employing too many indicators, leading to a confusing mix of signals and a paralysis of analysis.

To avoid this, concentrate on mastering a select few indicators that synergize well with each other and complement your trading strategy. This streamlined approach can be significantly more manageable and effective than attempting to juggle a multitude of variables in a complex trading model.

Guard Against the Perils of Overtrading

Overtrading is a common pitfall characterized by excessive trading or trading without a coherent strategy, often driven by emotional responses to market dynamics or a hasty desire to recover from losses.

This behavior can erode profits due to heightened transaction costs and suboptimal decision-making. Preventing overtrading involves establishing clear criteria for your trading strategy and adhering strictly to trades that meet these standards.

Implementing daily or weekly limits on your trading activity can also be beneficial. Successful trading is measured not by the volume of trades executed but by the quality and profitability of those transactions. Cultivating patience to await opportune moments is crucial for risk management and return optimization.

Maximize the Utility of Economic Calendars in Forex

Economic calendars are invaluable for tracking scheduled releases of economic indicators, governmental reports, and policy decisions, all of which can profoundly influence the financial markets.

These calendars play a vital role in strategizing trades around key events that might induce market volatility.

By keeping abreast of forthcoming announcements, traders can sidestep entering positions during potentially disadvantageous times or devise strategies to capitalize on anticipated market movements. An understanding of the varied impacts of different events is also instrumental in managing existing positions, possibly curtailing losses, or securing profits ahead of significant announcements.

Simplify Your Trading Approach

A convoluted trading strategy is not inherently superior. Embracing simplicity in your trading can enhance clarity, facilitate smoother execution, and ultimately lead to improved outcomes. Begin with a basic strategy that emphasizes a handful of fundamental principles and indicators.

As your experience and confidence grow, you can fine-tune and adapt your strategy, but the essence should remain uncomplicated.

This simplified methodology enables greater discipline, easier adherence to your trading plan, and more straightforward performance evaluations. The objective is consistent profitability, not the complexity of your strategy.

Embrace Continuous Learning and Humility

The forex market is perpetually evolving, with shifts in currency values, economic conditions, and global events continually reshaping the trading landscape. Irrespective of your level of success, there is always new knowledge to acquire and new strategies to explore.

Adopting a humble attitude and a commitment to lifelong learning enables you to adjust to these changes, discover innovative approaches, and refine your trading techniques continually.

Engaging with a broad array of educational resources, staying updated with market analyses, and interacting with fellow traders can unveil new perspectives and prevent stagnation. This commitment to ongoing education is a cornerstone of sustained trading success.

Resist the Urge to Chase Losses

The temptation to recoup previous losses by taking increased risks can set a dangerous precedent, often deviating from well-considered trading plans and amplifying losses.

It is critical, following an unsuccessful trade, to take a moment to analyze the situation comprehensively and ascertain the reasons behind the trade’s failure.

Utilizing these moments as opportunities for learning rather than catalysts for rash decisions is vital. Maintaining fidelity to your trading strategy and accepting losses as an integral component of the trading experience is essential for long-term achievement.

Cultivate Relationships Within the Forex Trading Community

Building connections with a community of traders can provide a wealth of support, insights, and diverse market perspectives. Whether through digital forums, trading collectives, or educational workshops, engaging with your peers enables the sharing of strategies, learning from collective experiences, and receiving constructive feedback on your trading approach.

This interaction not only fosters new ideas and identifies potential strategic missteps but also offers emotional support in what can often be a solitary pursuit. Networking with others who understand the challenges and intricacies of trading can be a source of motivation and encouragement, accelerating your learning process and enriching your trading journey.

The Lowdown on Forex Trading

Finally, navigating the Forex market successfully as a beginner hinges on receiving top-notch education and guidance. The Income Mentor Box Day Trading Academy excels in providing this, setting itself apart as the go-to resource for aspiring traders.

With a curriculum designed to cover every aspect of Forex trading, Income Mentor Box equips students with the tools needed for a prosperous trading career. The path to becoming a skilled Forex trader is clear. Take the leap with the Income Mentor Box Day Trading Academy and start shaping your successful trading journey today.

CLICK BELOW TO JOIN IMB 2.0